Have you ever heard of addiction to story? Apparently this is a real addiction, as shown below:

If you are not convinced that this addiction is real, watch this video:

See this cute little baby, so addicted to story until the point that he cried when the story has ended. Poor baby. I will buy you lots of books next time ok? 😂

As a matter of fact, I think I am addicted to stories. I crave for stories that can make me reflect on my life as well as story that managed to leave an impact in my heart.

I guess the reason why so many of us are addicted to stories is that stories allow us to experience a different life (especially a life that you can't have in the real life). All you need to do is to simply imagine yourself as one of the characters in the story.

For example, you could be flying in the sky, if you imagine yourself as Peter Pan.

Or you could go for an adventure in the Pacific Ocean, by imagining yourself as the little mermaid.

Or if you longed for the perfect love story (well in my opinion, this story is perfect enough), just imagine yourself as Cinderella.

I mean, what else can you ask for, if your love story is full of magic and a pumpkin carriage?

See my point? Life seems to be perfect, if we were to live in such a story. Story allows us to live a multiple life, if you like.

Stories are also useful tools for us to understand our life better. It trains us to be an empathy person. I believe that if you want to understand human being, you will need to read more stories and try to be empathy, i.e. try to understand the feelings of the characters in the story.

As such, I started to wonder about what makes a good story. To be exact, I want to know why certain stories stayed with us for a long period of time.

Thus, I decided to embark on a soul searching journey. Perhaps you can call it "The Quest for the Perfect Story".

To answer this question, I decided to go through three stories that have changed my life (i.e. stories that have change my world view or stories that allow me to understand our life better). I will explain why these stories have touched my heart, and I hope that we can find some common similarities between these stories.

1. Sword Art Online

Sword Art Online (SAO) is a Japanese anime which was introduced to me by one of my students (if you are reading this, thank you for introducing this anime to me because this anime had changed my life).

Basically, SAO is about VRMMORPG (virtual reality massively multiplayer online role-playing game). If you are not so familiar with this term, VRMMORPG means a virtual reality online game in which it allows a lots of player to play the game together at the same time.

I find this anime interesting because instead of facing computer screen when we play computer game, SAO allows the player to enter the gaming world via a technology called NerveGear.

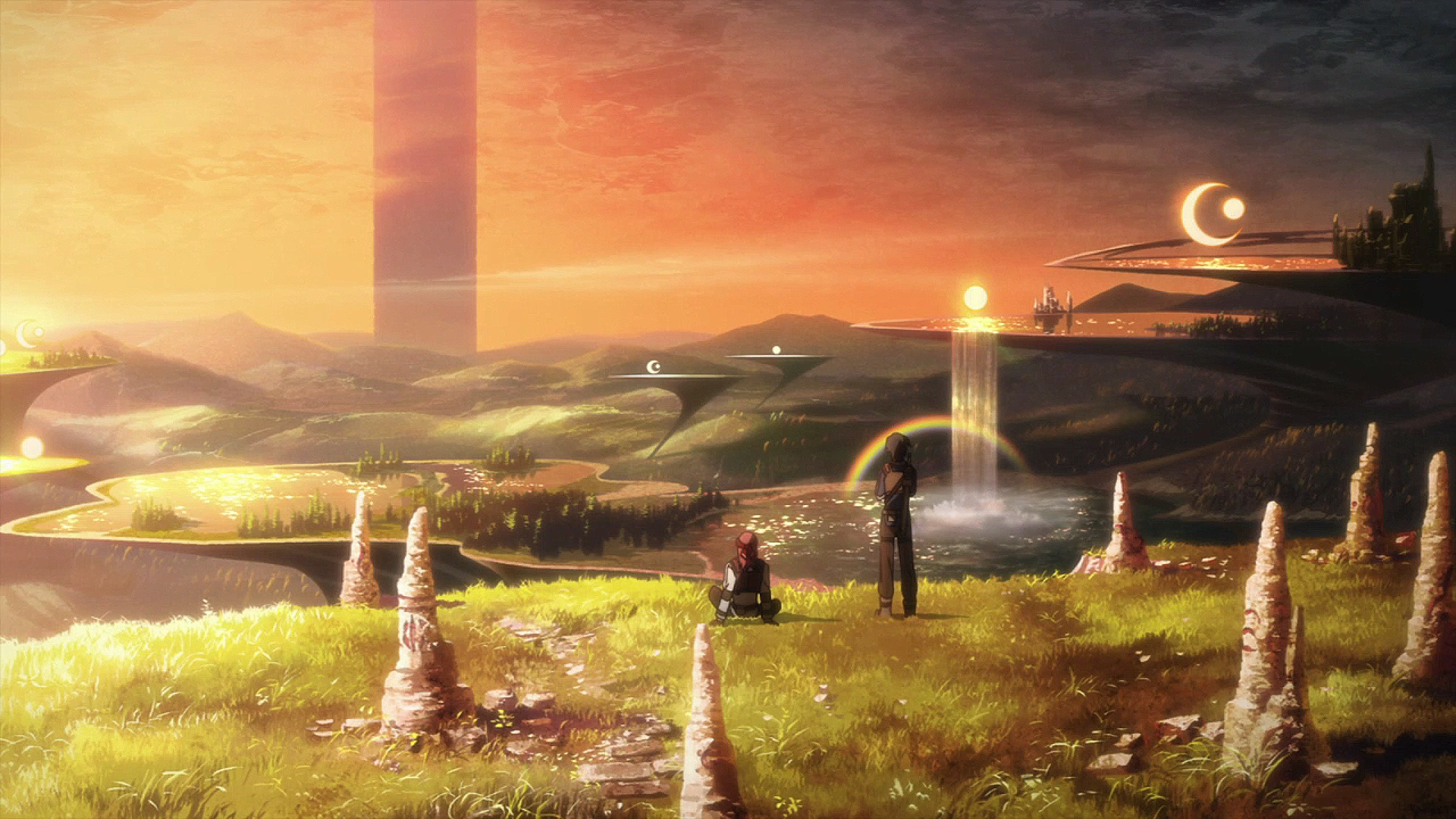

All you need to do is to install the NerveGear on your head (as shown in the diagram above) and the NerveGear will reroute all your brain signal into the game server. As such, you can enter the gaming world (Aincrad) which looks like this:

Imagine that you can live inside such a world. How perfect life would be.

However, there is a twist.

On the first day of official launch of SAO, many enthusiastic players entered the game. However, they realised that they can't log out the game.

Yes, you did not read that wrong. The players are trapped inside the game, with no ability to log out. There is also no way for you to control your body in the real life because NerveGear has rerouted all your brain signal to the game server.

Thereafter, we learn that this was done on purpose by the developer of the game, Kayaba Akihiko.

For no specific reason, he trapped 10,000 people in the game and he mentioned that the only way they can log out is to clear the 100 floors in Aincrad. However, if any player accidentally die in the game, the player will also be killed in the real life because NerveGear will automatically emit high-powered microwaves which can fry your brain. Any attempt to disconnect NerveGear by anyone in the real life will also have similar consequences.

10,000 people were trapped in such a game with no obvious reason. For no reason, they were forced to live in the game. For no reason, they were forced to try to clear the games in order to be able to return to the real world. The worst thing is that they may die trying.

Well if you find this story to be absurd, let me tell you that our life can be very absurd too. For no reason, we were born into this world. For no reason, we were forced to go to school, get a degree, and start working. Similarly, in our life, we may also die accidentally if we were not careful. Well eventually, we are going to die anyway. So what is the meaning of life then?

I will try to answer this question at a later part. But since we are on the topic of death, let's talk about the second story that has forever changed my life.

2. Tuesday with Morrie

Tuesday with Morrie is one of the best books that I have read in my life. It is always said that movie can make us shed tears due to the background music. However, I shed lots of tears after I read this book (even without any background music).

This is a story about an old man (Morrie), a teacher, who was diagnosed with amyotrophic lateral sclerosis (ALS) which has no known cure. And yes, death is inevitable for him.

It is funny isn't it? All these while when we were living, we never really thought of dying. It was only until the time when the doctor delivered the death sentence to us then we were hit by the reality - our days are numbered. Although we are going to die, the sun still shines brightly and other people will still continue on with their life. The world will not stop for us.

Read this quote from this book:

Perhaps it is very pessimistic for me to say this, but since we will die eventually, why should we study so hard for our exam? Why should we climb the corporate ladder in order to get a higher pay? Why should we torture ourselves so much?

My point is that after we worked so hard in our life, we will still die anyway. Why not we just enjoy our life to the max since our life is so meaningless after all?

Again, I will try to answer this question at a later part. Let's look into another story that made me think a lot about our life.

3. Lord of the Rings

I guess I have watched Lord of the Rings for around 5 times. I must say that each time I watched the movie, I learnt something different.

This is a story about two hobbits, Frodo and Sam attempting to take the One Ring to a volcano (Mount Doom) in hope of destroying the ring.

Both of them were not involved in the forging of the evil ring, but somehow they were tasked to embark on the journey to Mount Doom to destroy the ring.

To put things into perspective, this is the route that Frodo and Sam had taken in the Middle Earth:

According to this website, Frodo and Sam had walked a total of 1,350 miles (roughly 2,170km+) over a period of 6 months. This is roughly equivalent to travelling from Kuching to Sabah and from Sabah back to Kuching (on foot!).

Despite Frodo and Sam had no role in forging the evil one ring, they still had to bear the burden of the ring. They may get killed in the process too. True enough, they were captured or were almost captured multiple times in their journey.

What's the point of suffering so much for other people's mistake? Were there any hope at all for two small hobbits to actually reach Mount Doom and to destroy the ring? Well, Gandalf the wizard in Lord of the Rings had said this:

Perhaps what he said is true. Sometimes in life, we need to be a fool. We need to be foolish enough to believe that there are still some hope, despite everyone telling us to give up.

Similarities in the Three Stories

By now you may have realised some recurring questions - is our life meaningless after all? Why must we suffer so much in our life? We will be dead at the end of the day anyway.

My friend, if you are still reading, I hope you realised that these stories are sharing a common plot - the characters were in a situation in which there weren't much hope. However, you should also realised that these characters never give up in these stories.

In Tuesday with Morrie, despite knowing that he would die eventually, he still wanted to try to help as many people as possible. This including sharing the life lessons with one of his ex-student (the author) so that the author can write a book about life and death. According to Morrie,

Morrie also said this:

To fully understand the meaning of offering others what you have to give, you will have to experience it yourself by reading the book. Allow me to share with you one part of the novel that really made me shed tears:

What about Lord of the Rings? I will let Sam to explain to you the significance of this story. Watch this video (a very touching speech by him).

“It's like in the great stories, Mr. Frodo. The ones that really mattered. Full of darkness and danger they were. And sometimes you didn't want to know the end. Because how could the end be happy? How could the world go back to the way it was when so much bad had happened? But in the end, it’s only a passing thing, this shadow. Even darkness must pass. A new day will come. And when the sun shines it will shine out the clearer. Those were the stories that stayed with you. That meant something, even if you were too small to understand why. But I think, Mr. Frodo, I do understand. I know now. Folk in those stories had lots of chances of turning back, only they didn’t. They kept going, because they were holding on to something. That there is some good in this world, and it's worth fighting for.”

Lessons Learnt

I think Sam has summarised the lessons learnt well. Our life is indeed meaningless (or hopeless if you want). Sometimes we were in the situation where we can't even see the light at the end of the tunnel. How could the ending be happy, when our life sucks to the max?

However, these stories appeal to me because in the end, there will be a happy ending (spoilers alert!).

In SAO, despite the sacrifice of some players who will never come back to life, the game was finally cleared.

In Tuesday with Morrie, even though Morrie passed away eventually, he left us with an invaluable gift, i.e. life lessons in the book.

In Lord of the Rings, the ring was successfully destroyed after so much of struggles and hardship.

So is life really meaningless? I guess not. Let's be a fool to believe that there are still some hope in our life. Let's be a fool to believe that there are still something good in this world which is worth fighting for, and believe me, whatever sufferings that you and I are facing now are temporary. It will not last forever and a better tomorrow will definitely come.

It is true that we are going to die at the end of our life, but this doesn't render our life meaningless. Why not we try our best to create an interesting life? Why not we try our best to create something permanent in this temporary life?

The Perfect Story

Coming back to the quest for the perfect story. After all the analysis above, I hope you realised that each story is unique in its own way. Perhaps we shouldn't make this quest as our number one priority in life.

Instead of hoping that you exist in a perfect story, why not we try our best to create one ourselves? After all, you are living your own life. You only live once (YOLO). Make it meaningful, and I guess that shall be our ultimate quest for the perfect story.

:max_bytes(150000):strip_icc()/research_pharma-5bfc322b46e0fb0051bf11a0.jpg)