I remember the time when I first encounter the topics of foreign exchange, I got really confused when it comes to the conversion of foreign currency to home currency. For example, in the Financial Management (FM) papers, they could give you two exchange rate as follows:

Spot exchange rate: 4.1780 – 4.2080 euros per $

|

| Exactly my reaction. Which one to choose? |

As such, this post intends to introduce to you the basic of foreign exchange as well as guiding you on the exchange rate that you are supposed to choose in your exam. Hopefully after reading through this post, you can tackle foreign exchange questions with more confidence.

To understand which rate to use, we need to understand how foreign exchange works. I will use Malaysia as a home country (Reason: I am from Malaysia and Malaysia is my home).

|

| P.S. Jalur Gemilang (Stripes of Glory) is the name of Malaysia's flag. |

|

| This is the US flag. It looks quite the same as our Jalur Gemilang eh? Maybe some day someone can enlighten me with the reason behind the similarity. |

In Malaysia, the currency that we use is Ringgit Malaysia (RM).

|

| No, this is not my money. (P.S. our currency is very colourful, just like monopoly money 😍😍😍) |

Since our Jalur Gemilang is so similar with the US flag, I will use US dollar as the foreign currency in my illustration. Let's say I want to exchange RM100 to United States Dollar (USD).

|

| Is USD more handsome than RM? 😂😂😂 |

To determine how much USD we can get, we will need to refer to the exchange rate. According to our Bank Negara Malaysia (central bank of Malaysia) website, the middle exchange rate as of today (4 September 2019, for session 1200) is:

RM4.2125/USD

This means that if you have 1 USD, you are going to get RM4.2125.

Illustration 1

So if I have RM100, to convert this into USD, I will need to perform the following calculations:

RM100 / (RM4.2125/USD) = USD 23.74

In other words, with RM100, I can only get USD 23.74 if the exchange rate is RM4.2125/USD.

|

| I am so sad, my money has shrunken 😭😭😭 |

USD100 x RM4.2125/USD = RM421.25

|

| I get more RM if I convert from USD to RM. Therefore, I am rich (only in my imagination) 😂 |

For the purpose of this post, I will use some terms in relation to the exchange rate. Let's refer to the same exchange rate that I used above: RM4.2125/USD

In this case,

1. I will call RM as our quote currency.

2. I will call USD as our base currency.

In other words, whenever we refer to the base currency, we always refer to it as just 1 unit. As such, in the above exchange rate, it means that 1 USD (base currency) is equal to RM4.2125 (the quote currency).

It is possible for us to change the quote and base currency by the following calculation:

1 / 4.2125 = USD0.2374/RM

This is just another way for us to express our foreign exchange rate. In other words, RM1 is equal to USD0.2374.

Note that in ACCA exam, the quote currency and base currency can be used interchangeably. This means that sometimes you will see USD as base currency, sometimes you will see USD as the quote currency. Make sure you read the questions carefully before attempting any calculation.

I will now illustrate the calculation to you using this rate.

Illustration 2

Let's say I have RM100 and I want to convert it to USD, the calculation will be as follows:

RM100 x USD0.2374/RM = USD23.74

Now let's say I have USD 100 and I want to convert it to MYR. The calculation will be as follows:

USD100 / (USD0.2374/RM) = RM421.23

You should see that the answer for Illustration 1 is the same as Illustration 2 (the small difference is due to rounding adjustment).

|

| Sorry, only the rounding adjustment is immaterial. Not everything is immaterial ok! |

Important Lessons From The Above Illustrations

From illustration 1 and 2, you should have noticed that sometimes we multiply and sometimes we divide. The questions that I believe a lot of students will ask is, when are we supposed to multiply and when are we supposed to divide?

|

| Mind blown 😂😂😂 Please ignore this - this is irrelevant for foreign exchange 🙈🙊 |

Anyway back to the question of when we should multiply or divide. This is actually a mathematics question - and it is a valid one. Because if you do it wrongly, your answer will be wrong all the way. As such, let's find a way to determine when do we multiply or when do we divide.

The idea is this:

1. If the currency that you want to convert is the same as the quote currency, then you will use division.

2. If the currency that you want to convert is NOT the same as the quote currency, then you will use multiplication.

For example, let's look at Illustration 1 and 2 above. The scenarios in which we use division are as follows (notice the currency in red colour below):

RM100 / (RM4.2125/USD) = USD 23.74

USD100 / (USD0.2374/RM) = RM421.23

As you can see, the currency that you want to convert and the quote currency are the same. As such, we use division.

Let's now look at the scenarios in which we use multiplication:

USD100 x RM4.2125/USD = RM421.25

RM100 x USD0.2374/RM = USD 23.74

As you can see, the currency that you want to convert and the quote currency are NOT the same. As such, we use multiplication.

That's the whole idea of whether we use multiplication or division. Use this techniques and I believe you will get the right answer in your exam.

Concerning Two Exchange Rates

Let's come back to the exchange rate that I introduced to you at the beginning of this post:

Spot exchange rate: 4.1780 – 4.2080 euros per $

The question is, why is there two exchange rates? Which one should I use in my calculations?!

To understand the reasons for two rates, we need to stand in the shoes of a bank or foreign currency exchange counter.

Let's me repeat this again as this is important. We must look at the issue from the point of view of the bank!

Basically, the bank is doing a business when they help you to convert foreign currency (i.e. they want to earn some profit by helping you to exchange foreign currency). The very basic idea of how you earn profit in business is to buy something at a cheaper price and sell it at a higher price.

The same principle is applied for foreign exchange. However, depending on how you quote the currency, it can be very confusing. I will try to clear your confusion here.

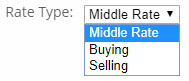

Let's refer to the Bank Negara Malaysia website again. You would have realised that there is an option for you to choose (whether you want buying rate or selling rate):

In the exam, if you are given two rates, they are essentially buying rate and selling rate. Buying rate is also known as the ask rate / offer rate; whereas selling rate is also known as the bid rate. For the purpose of the illustration in this post, I will just use the terms buying rate and selling rate.

I will use the buying rate and selling rate as shown in Bank Negara Malaysia website today (4 September 2019, for session 1200) to illustrate the difference:

Buying rate - RM4.2100/USD

Selling rate - RM4.2150/USD

The difference between the buying rate and selling rate (RM0.005) is known as the spread.

Let's consider the following scenarios.

Scenario 1

Let's say we receive USD100 and we want to exchange it to RM. We can actually rephrase this scenario in the following manner:

We sell USD100 to the bank. Bank will buy USD100 from us by paying us in RM.

To determine which rate to use, we must look at the case from the point of view of the bank. The bank is buying USD from us. As such, bank will use the buying rate.

In other words, we will receive RM421 by selling USD100 to the bank (refer to the following calculation). Alternatively, we can also say that bank buys USD100 from us and give us RM421.

USD100 x RM4.2100/USD = RM421

Scenario 2

Let's say we need to pay a foreign supplier USD100. We need to determine how much RM we need to pay in order to get USD. Similar to Scenario 1 above, we can rephrase this scenario in the following manner:

We want to buy USD100 from the bank so that we can pay our supplier in USD. Bank will sell USD100 to us.

To determine which rate to use, we must look at the case from the point of view of the bank. The bank is selling USD to us. As such, bank will use the selling rate.

In other words, we will need to pay RM421.50 to the bank in order to buy USD100 (refer to the following calculation). Alternatively, we can also say that the bank sells USD100 for RM421.50.

USD 100 x RM4.2150 = RM421.50

Analysis of Scenario 1 and 2

Let's now think from the perspective of the bank.

When the bank buy USD100 from us, bank will give us RM421. But when the bank sell USD100 to us, they are going to charge us RM421.50.

In this transaction, bank will earn a profit of RM0.50.

In other words, bank will definitely want to earn money from you.

|

| P.S. We can't blame the bank because they are doing a business. They need to make a profit to survive. |

But What if We Switch the Quote Currency and Base Currency?

VERY IMPORTANT

Buying rate is not necessary the lower rate and the selling rate is not necessary the higher rate!!

Buying rate is not necessary the lower rate and the selling rate is not necessary the higher rate!!

Buying rate is not necessary the lower rate and the selling rate is not necessary the higher rate!!

Very important, that's why I repeat this three times.

This is because if we switch the quote currency and base currency, the buying and selling rate will be expressed in a different manner as illustrated below:

Buying rate

RM4.2100/USD can be expressed as USD0.2375/RM.

1 / (RM4.2100) = USD0.2375/RM

Selling rate

RM4.2150/USD can be expressed as USD0.2372/RM.

1 / (RM4.2150) = USD0.2372/RM

You will notice that once I switch the quote currency with the base currency, the buying rate is now higher than the selling rate.

This is the part which confuses me when I was a student. The reason is because in ACCA exam, most of the time they quote the currency in such a manner (in which buying rate is higher than the selling rate). As such,

Buying rate is not necessary the lower rate and the selling rate is not necessary the higher rate!!

Buying rate is not necessary the lower rate and the selling rate is not necessary the higher rate!!

Buying rate is not necessary the lower rate and the selling rate is not necessary the higher rate!!

Very important, that's why I repeat this three more times. 😂😂😂

Let's try to see what does these rates mean.

Buying rate is RM4.2100/USD and the selling rate is RM4.2150/USD

Analysis: The bank will buy 1 USD at RM4.2100 and sell 1 USD at RM4.2150, thereby making a profit of RM0.005 for every 1 USD.

Buying rate is USD0.2375/RM and the selling rate is USD0.2372/RM

Analysis: The bank will buy USD0.2375 for RM1. When the bank sells USD, they will give away USD0.2372 for RM1. In other words, initially they receive USD0.2375, then they give out USD0.2372, thereby making a profit of USD0.0003 for every RM1.

Basically, when the bank buys USD, they will receive more USD (hence a higher rate). When they sells USD, they will give away lesser USD (hence a lower rate).

Let's apply this rate to Scenario 1 and 2 above (the case is reproduced below again for your easy reference, the only difference is the calculation).

Scenario 1

Let's say we receive USD100 and we want to exchange it to RM. We can actually rephrase this scenario in the following manner:

We sell USD100 to the bank. Bank will buy USD100 from us by paying us in RM.

To determine which rate to use, we must look at the case from the point of view of the bank. The bank is buying USD from us. As such, bank will use the buying rate.

In other words, we will receive RM421.05 by selling USD100 to the bank (refer to the following calculation). Alternatively, we can also say that bank buys USD100 from us and give us RM421.05.

USD100 / (USD0.2375/RM) = RM421.05

Scenario 2

Let's say we need to pay a foreign supplier USD100. We need to determine how much RM we need to pay in order to get USD. Similar to Scenario 1 above, we can rephrase this scenario in the following manner:

We want to buy USD100 from the bank so that we can pay our supplier in USD. Bank will sell USD100 to us.

To determine which rate to use, we must look at the case from the point of view of the bank. The bank is selling USD to us. As such, bank will use the selling rate.

In other words, we will need to pay RM421.59 to the bank in order to buy USD100 (refer to the following calculation). Alternatively, we can also say that the bank sells USD100 for RM421.59.

USD 100 / (USD0.2372/RM) = RM421.59

Analysis of Scenario 1 and 2

You would have realised that the answer is the same as per the previous scenarios (the small difference is again due to rounding adjustment).

When the bank buy USD100 from us, bank will give us RM421.05. But when the bank sell USD100 to us, they are going to charge us RM421.59.

In this transaction, bank will earn a profit of RM0.54.

Again, no matter what happen, bank will definitely want to earn money from you.

Shortcut in Exam

In exam, going through this thought process can be very tedious and tiring. As such, I will not recommend you to use the above thought process in exam. My explanation above are to make you understand how foreign exchange works in real life only. There is a shortcut that you can apply in exam.

| Shortcut in exam is always fantastic! |

I will use the same scenarios as per above.

Buying rate = RM4.2100/USD or USD0.2375/RM

Selling rate = RM4.2150/USD or USD0.2372/RM

The good news is that you do not need to be concerned with the quote currency and base currency in exam. You also need not worry whether is it buying rate or selling rate. All you need to determine are:

1. Is the transaction receipt or payment?

2. Are you going to multiply or divide?

To answer question no.1, remember this:

Because the bank is going to earn profit from you, you will always receive less from the bank and you will always pay more to the bank.To answer question no.2, I have already explained it previously. I will reproduce my explanation for you here again:

1. If the currency that you want to convert is the same as the quote currency, then you will use division.

2. If the currency that you want to convert is NOT the same as the quote currency, then you will use multiplication.For example, if you have USD 100, you will first convert it using both buying and selling rates:

Buying Rate

|

USD 100 x RM4.2100

= RM421.00

|

USD 100 / (USD0.2375/RM)

= RM421.05

|

Selling Rate

|

USD 100 x RM4.2150

= RM421.50

|

USD 100 / (USD0.2372/RM)

= RM421.59

|

If the question in your exam mentions that you receive USD100 and you wish to convert it to RM, just choose the lower figure (RM421 or RM421.05).

If the question in your exam mentions that you need to pay USD100 and you wish to convert it to RM, just choose the higher figure (RM421.50 or RM421.59).

There you go! It is not difficult if you use this shortcut in exam. Just remember we receive less and we pay more.

Conclusion

Foreign exchange can be confusing, but there is an easy way you can use to tackle such questions in exam. Do not simply memorise the calculation. Instead, remember the very important three rules as follows and apply them in exam:

1. You will always receive lesser and will always pay more.

2. If the currency that you want to convert is the same as the quote currency, then you will use division.

3. If the currency that you want to convert is NOT the same as the quote currency, then you will use multiplication.

With this, you can now try to attempt some past year questions by applying the three important rules above. Try to see if you can select the right exchange rate or not.😉

No comments:

Post a Comment