Note: This post is suitable for ACCA students who are studying for Financial Reporting (FR) or Strategic Business Reporting (SBR). However, SBR students will need to know the accounting treatments for both lessor and lessee whereas FR students will only need to know the accounting treatments for lessee.

Let's start with clarifying the difference between lessor and lessee:

Lessor - the person who rents out an asset to lessee. Lessor will collect rental income from lessee.

Lessee - the person who uses the rented asset of lessor. Lessee will pay rental income to lessor for the right of use of the leased asset.

Therefore, in a normal leasing scenario, this is what happens:

1. Company A (seller) sells the asset to Company B (buyer). Company B will pay Company A for the purchase of asset.

Before we proceed, make sure you understand and remember this:

Seller = Lessee

Buyer = Lessor

The reason why an entity decides to engage in such transactions is because it is a way to obtain funding. When Company A sell off their asset, Company A will get a lump sum amount from Company B. Thereafter, they just need to pay rental to Company B. As such, from Company A's perspective, Company A will be able to have a better cash flows because they receive one lump sum amount upfront and the future cash outflows are just rental payments.

So now the first important question to be asked is this:

The reason why this is important is that when we prepare financial statements, we need to reflect substance over form. Our financial statements should "represent faithfully the substance of the phenomena it purports to represent" (conveniently copied and pasted from the 2018 IFRS Conceptual Framework).

As there is no sale of asset by Company A, Company A will not derecognise their asset. Instead, Company A will recognise a financial liability (i.e. a loan or liability) under IFRS 9 when they receive the fund.

Dr Bank XX

Cr Financial Liability (Loan Payable) XX

Company B will recognise a financial asset when they provide loan to Company A:

Dr Financial Asset (Loan Receivable) XX

Cr Bank XX

This can be represented using the diagram below:

Solutions

As Company B obtains a property which will be rented out to Company A, Company B has obtained an investment property under IAS 40.

Note: If the leased asset is a plant and machinery, then the buyer / lessor would have acquired property, plant and equipment (PPE) under IAS 16.

So now the first important question to be asked is this:

For the first transaction (i.e. the sales from Company A to Company B), is it really a sale or is it just a way for Company A to obtain a loan (i.e. the asset "sold" is just a collateral for the loan)?

|

| I mean obtain a loan, not forever alone! |

I don't know if this is true but thank you for inventing copy and paste!!!😂😂😂

Anyway back to substance over form. The idea is that if it is a sale, then we reflect it as sales in financial statements. If it is not a sale, then it is a loan, so we need to reflect the loan in financial statements.

The next important question that we need to ask is:

How do we determine whether a transaction is a sale?

To answer this question, let's look at what paragraph 99 of IFRS 16 says:

An entity shall apply the requirements for determining when a performance obligation is satisfied in IFRS 15 to determine whether the transfer of an asset is accounted for as a sale of that asset.

Let's look at what IFRS 15 has to say about satisfying a performance obligation (paragraph 31 of IFRS 15):

An entity shall recognise revenue when (or as) the entity satisfies a performance obligation by transferring a promised good or service (i.e. an asset) to a customer. An asset is transferred when (or as) the customer obtains control of that asset.

As such, we can now conclude that a transaction is a sale if Company B obtains control of the asset sold by Company A. If Company B does not obtains control of the asset, then Company B is actually providing a loan to Company A.

Let's elaborate the accounting treatments below:

When The Transaction Is NOT a Sale

So if the first transaction is not a sale, it means that Company A still control the asset and Company B do not have any control of the asset. In substance, Company A is borrowing money from Company B and Company A is providing the asset as collateral (security) for the loan. This is represented in the diagram below:

Dr Bank XX

Cr Financial Liability (Loan Payable) XX

Company B will recognise a financial asset when they provide loan to Company A:

Dr Financial Asset (Loan Receivable) XX

Cr Bank XX

The subsequent "rental" payment made by Company A to Company B is not a rental payment, but it is actually repayment of the loan, as shown below:

So from Company A's point of view, the double entry for such repayment of loan will be something like this:

Dr Financial Liability (Loan Payable) XX

Dr Finance Cost (interest expense in Profit or Loss) XX

Dr Finance Cost (interest expense in Profit or Loss) XX

Cr Bank XX

For Company B, the double entry when they receive the repayment of the loan will be something like this:

Dr Bank XX

Cr Financial Asset (Loan Receivable) XX

Cr Finance Income (interest income in Profit or Loss) XX

The financial liability of Company A and the financial asset of Company B will be dealt with under IFRS 9 and generally both of them will be accounted for using amortised cost if the criteria under IFRS 9 are fulfilled.

Note that we will not cover the accounting treatment of IFRS 9 in this post.

When The Transaction IS a Sale

So if the first transaction is a sale, it means that Company A does not control the asset anymore because the control has been transferred to Company B. As such, Company A (seller) should record the sale of asset (i.e. the asset is derecognised and a gain/loss on disposal should be recognised).

However, this is not as straightforward as a normal disposal of asset. This is because in a normal disposal of asset, the seller will transfer 100% of the asset to the buyer. After the sale, the seller will no longer use the asset. In this case, the seller recognises the full (100%) gain or loss on disposal.

But for sales and leaseback, the seller will subsequently leaseback the asset and continue to use the asset. As such, the disposal is not 100% because the seller still has the right to use the asset after the disposal.

In other words, the seller still retains some of the portion of the asset originally owned (because the seller is still using it after the sales).

As such, in order to faithfully represent the sales and leaseback, because the disposal is not 100%, the seller can only treat the disposal as partial disposal. This means that seller DOES NOT recognise 100% of the gain or loss on disposal. Seller only recognises part of the gain, i.e. recognises the gain or loss for the portion that is transferred to the buyer or lessor.

To make the above points clearer:

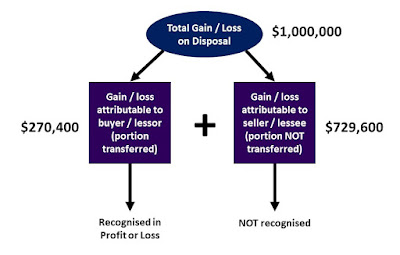

1. The gain or loss TO BE recognised in Profit or Loss by the seller is only the portion of the gain or loss that is transferred to the buyer (lessor). In short, we call this portion as gain or loss attributable to the buyer / lessor.

2. The portion of the gain or loss that is not transferred to the buyer (lessor) is NOT recognised by the seller. In short, we call this portion gain or loss attributable to the seller / lessee (Note: attributable to seller / lessee as it represents the portion not transferred to buyer. Not transferred means still belong to seller, hence attributable to seller).

Let's use an example to illustrate the above:

Company A sells a building to Company B for cash of $2 million. The fair value of the building is equal to the cash consideration of $2 million. The carrying amount of the building immediately before the sale is $1 million.

At the same time, Company A enters into a contract with Company B for the right to use the building for 18 years, with annual payments of $120,000 payable at the end of each year. The interest rate implicit in the lease is 4.5%, which results in a present value of the annual payments of $1,459,200.

The sale of the building to Company B meets the definition of a sale under IFRS 15.

|

| Company A sells building to Company B at $2 million |

|

| Company A leases back the building and pay annual rental of $120,000 to Company B. |

As the transactions is a sale, we shall account for it as a sale.

Seller / Lessee Accounting

In general, there are four (4) steps to be followed for a sale and leaseback scenario if we are performing the accounting for seller / lessee.

Step 1 - Derecognise the Asset

The first step is to account for the sale of the building. In other words, the building will be derecognised and a gain or loss is recognised.

Note: For Step 1, we will treat the derecognition as if it is a full disposal (i.e. to treat the derecognition normally) for now. We will adjust for partial disposal later on in Step 3 and 4.

Dr Bank $2m

Cr PPE $1m

Cr Gain on disposal $1m

As shown in the double entry above, the gain on disposal is $1 million. However, this represents the total gain of disposal. As we can only recognise the gain attributable to the buyer / lessor, we will need to remove the gain attributable to seller / lessee from the total gain (this will be shown in Step 3 and 4 later).

Step 2 - Recognise the Leaseback

The second step is to recognise the leaseback of the building from Company B. According to IFRS 16, the lessee shall recognise a right-of-use asset and a lease liability based on the present value of the lease payment ($1,459,200).

Dr Right-of-use asset $1,459,200

Cr Lease liability $1,459,200

Step 3 - Calculate the Gain Attributable to Seller / Lessee (Portion of Gain Not Transferred to Buyer / Lessor)

Now we will need to calculate the gain which is attributable to Company A (the seller / lessee). In other words, we are now calculating the portion of the gain not transferred to the buyer / lessor. Remember that portion of gain not transferred to buyer / lessor cannot be recognised in Profit or Loss. As we have recognised 100% gain in Step 1, we shall remove the gain calculated in this step from the total gain at a later stage in step 4.

Based on the question, the present value of lease payment is $1,459,200. This represents the present value of the lease payment that Company A is required to pay in the future. In other words, this value belongs to Company A (seller / lessee).

As such, we can come out with a ratio as follows:

In other words, Company A will pay a present value of $1,459,200 for the asset and this is 72.96% of the total fair value of asset. We can therefore say that Company A is using 72.96% of the asset.

As such, we cannot recognise 72.96% of the gain because 72.96% of the gain is attributable to Company A - the seller / lessee. We can only recognise the remaining 27.04% of the gain (i.e. gain that is attributable to the buyer / lessor - Company B).

We shall use this ratio to multiply with the total gain on disposal of $1 million in order to find the gain attributable to seller / lessee:

After this calculation, we can move into Step 4.

Step 4 - Remove the Gain Calculated in Step 3 from Total Gain Calculated in Step 1

In this step, we remove the gain by debiting gain on disposal. The corresponding adjustment is made to the right-of-use asset.

Dr Gain on disposal $729,600

Cr Right-of-use asset $729,600

In order words, from the total gain of $1 million, we have removed the gain attributable to seller / lessee of $729,600. What is left behind is the gain attributable to buyer / lessor, which is $270,400, as shown below:

That's all for the adjustment for sales and leaseback.

Summary

Below represents the summary of all the double entries from Step 1 to Step 4

Dr Bank $2,000,000

Dr Right-of-use Asset (1,459,200-729,600) $729,600

Cr PPE $1,000,000

Cr Lease Liability $1,459,200

Cr Gain on disposal (1,000,000-729,600) $270,400*

* Gain attributable to buyer / lessor

Subsequently, the requirement of lessee under IFRS 16 will be applied.

Note: The value of the right-of-use asset as shown above ($729,600) can also be calculated using the following method:

Right of use asset

= Ratio of portion attributable to seller or lessee x Previous carrying amount of the asset

Applying the same logic of partial disposal, the right-of-use asset represents the portion of the previous carrying amount of the asset retained by the seller / lessee (i.e. 72.96% of $1,000,000).

Note: The value of the right-of-use asset as shown above ($729,600) can also be calculated using the following method:

Right of use asset

= Ratio of portion attributable to seller or lessee x Previous carrying amount of the asset

Buyer / Lessor Accounting (Relevant for SBR only)

As Company B (buyer / lessor) obtains control of the building, Company B will recognise the asset.

Dr Investment Property $2 million

Cr Bank $2 million

Cr Bank $2 million

As Company B obtains a property which will be rented out to Company A, Company B has obtained an investment property under IAS 40.

Note: If the leased asset is a plant and machinery, then the buyer / lessor would have acquired property, plant and equipment (PPE) under IAS 16.

The subsequent lease to Company A would depend on whether it is a finance lease or operating lease. The requirement of lessor under IFRS 16 will be applied from this point onwards (which will not be covered in details in this post).

Generally, if the lease to Company A qualifies as finance lease, then the investment property will be derecognised and a financial asset will be recognised (this financial asset is also known as net investment in lease). Finance income will be recognised and any payment received from Company A will reduce the net investment in lease.

If the lease to Company A qualifies as operating lease, then the investment property will not be derecognised. Instead, Company B will recognise the rental income received from Company A on a straight line basis. Generally, the investment property will be measured using fair value model under IAS 40, with the changes in fair value reflected in the Profit or Loss. If the leased asset is PPE, then it will be held under cost model or revaluation model under IAS 16.

Generally, if the lease to Company A qualifies as finance lease, then the investment property will be derecognised and a financial asset will be recognised (this financial asset is also known as net investment in lease). Finance income will be recognised and any payment received from Company A will reduce the net investment in lease.

If the lease to Company A qualifies as operating lease, then the investment property will not be derecognised. Instead, Company B will recognise the rental income received from Company A on a straight line basis. Generally, the investment property will be measured using fair value model under IAS 40, with the changes in fair value reflected in the Profit or Loss. If the leased asset is PPE, then it will be held under cost model or revaluation model under IAS 16.

Hope that you will find the above illustrations useful!

I will write about the case for sales and leaseback in which the selling price is not equal to the fair value of the asset transferred in Part 2. Stay tuned!

No comments:

Post a Comment